Are you trying to improve your spending habits? Or just trying to save more money in the new year? Then, a no-buy January could be the best financial challenge to join in the beginning of the year.

I will be doing my own no buy January as a way to set intentions for the year and feel in control of my finances and spending habits. If this sounds like something you are trying to achieve too, join me as I explain the 3 steps to complete a no-buy January successfully. I’m including a fun template to help you in the challenge too!

Table of Contents

Why Do a No Buy January?

A no buy January is a chance to reclaim your financial freedom by breaking the spending habit after the Holidays. It’s also a great way to start the year on a good note and redirect those funds towards your dreams – maybe that vacation or padding up that emergency fund.

This challenge can be a fantastic opportunity to be mindful of your spending habits. You’ll be surprised how much joy and satisfaction intentional choices can bring.

3 Steps to a Successful No Buy January

Alright, so you’ve decided to take on the challenge of a no-buy January. Now, let’s talk about how you can actually make it happen.

Step 1: Set rules

Let’s map out the game plan by setting some ground rules. First things first, be realistic. This isn’t a one-size-fits-all deal. Tailor your rules to your life, your needs, and your goals. Maybe it’s a cap on daily coffee runs or a limit on online shopping binges – you call the shots.

Secondly, give yourself a little wiggle room. It’s okay to have exceptions, like necessary groceries or that unexpected coffee date with a friend. We’re all human, and life comes with surprises. Flexibility is key!

Lastly, write it down. Seriously, jot those rules on paper, or type them out – whatever works for you. When in doubt, refer back to your rules, and let them be your guiding star through the no-buy adventure. So, what are your rules going to be? These are mine:

- No clothes or shoes

- No makeup or skincare

- No Starbucks or coffee shops unless it’s a coffee date

- No random home decor or organization products

- Limit eating out to once a week

Step 2: Eliminate triggers

Now that you’ve got your no-buy rules in place, let’s talk about eliminating those sneaky spending triggers. First off, identify your spending triggers. Are you lured into buying things when you’re stressed, bored, or maybe just scrolling through your favorite online store?

Next, create a safe zone. If online shopping is your kryptonite, maybe delete those shopping apps for the month. Or if the mall is your weakness, consider taking a different route home.

Lastly, find alternative outlets. If stress triggers your spending, maybe try yoga or a good book instead. Replace the spending habit with something positive.

Personally, these are the steps I’m taking towards eliminating my shopping triggers:

- Eliminate all shopping apps except from Amazon (I need it for some essentials)

- Unsubscribe from all stores email distribution lists

- Skip TikTok videos that involve clothes, shoes or viral Amazon finds.

Step 3: Keep track of progress

Congratulations! You’ve navigated through setting rules and defeating spending triggers. Now, let’s talk about tracking progress.

First off, choose your tracking tool. Whether it’s a good old-fashioned notebook, a budgeting template, or a fancy spreadsheet – find what suits your style.

Schedule some time each day to update your tracking tool. It should take less than a minute, so do it after your evening skincare or right after journaling, whatever works for you.

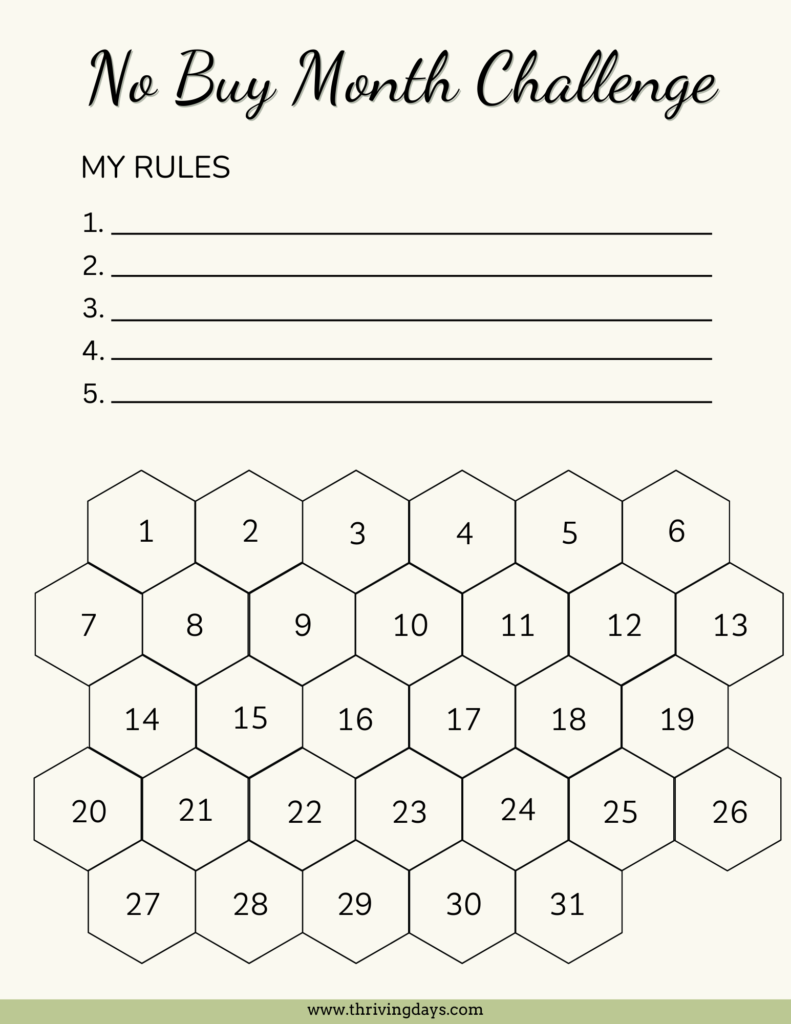

I have created this simple but fun template to help me stay on track. If you like it, print it and use it for your no-buy challenge.

Reflecting on the experience

After you complete your no-buy January, it is important to reflect on the journey. Did you discover new coping mechanisms for stress or find joy in simpler pleasures? Take note of the strategies that worked like magic.

Consider the lessons learned. Did you find yourself questioning the value of certain purchases? Did the month reveal any surprising spending patterns or highlight areas where you thought you needed more than you actually did?

Transitioning to Post-No-Buy Life

Firstly, ease back into discretionary spending gradually. Consider setting a new monthly budget that aligns with your financial goals while allowing for some flexibility. This step ensures you maintain control over your spending without feeling overwhelmed.

Reflect on the impact of your no-buy January. What habits and perspectives do you want to carry forward? Perhaps you’ve discovered a newfound appreciation for frugality or identified areas where you can continue to cut back. Embrace these insights as you shape your post-no-buy approach.

Reintroduce non-essential spending mindfully. Whether it’s dining out, treating yourself to a new book, or enjoying a leisure activity, approach these expenses with intention. Ask yourself if each purchase aligns with your values and contributes positively to your life.

Consider implementing sustainable spending habits. Explore ways to continue saving money, such as meal planning, embracing second-hand shopping, or choosing experiences over material possessions. These habits can contribute not only to financial well-being but also to a more environmentally conscious lifestyle.

Final Thoughts

Remember, this is just the beginning of a year filled with conscious choices, financial well-being, and a mindset that values experiences over possessions. Here’s to a year ahead where your financial decisions align with your dreams, and every purchase carries the weight of purpose and joy.