Are you ready to take control of your finances and embark on a transformative journey to financial security? Welcome to the 6-Month Savings Challenge!

If you are new to saving, I know it can be intimidating. I have gone through my own share of saving challenges and no-buy challenges in my journey to paying off my student debt. Based on my personal experience and lessons learned, I’ll provide you with a step-by-step roadmap to help you navigate your way through this exciting savings challenge. By committing to this 6-month savings challenge, you’ll not only learn valuable financial habits but also gain the confidence to secure your financial future. Let’s get started on this rewarding journey to financial success, one step at a time!

Table of Contents

1.Setting Your Savings Goal

It all begins with setting a clear and achievable savings goal. This is where you lay the foundation for your financial journey.

Your goal should be crystal clear. Instead of saying, “I want to save money,” specify how much you want to save and for what purpose. For example, “I want to save $10k in the next 6 months to start building my emergency fund”

If you’re new to saving, it’s perfectly fine to start with a modest goal. Setting an achievable target, like saving $1000 in six months, is a great way to build your confidence and establish a savings habit. As you gain confidence and experience, you can gradually increase your savings goals. Challenge yourself, but always ensure it remains realistic.

2.Creating a Budget

Now that you’ve set your savings goal, it’s time to create a budget that’ll help you get there. If you are new to budgeting, follow these steps to make the process easier.

Income Assessment

Begin by looking at your sources of income. This includes your salary, freelance work, side gigs, and any other money that flows into your wallet. Make a list of these sources and their amounts.

Expense Breakdown

Next, examine your expenses. This includes rent or mortgage, groceries, utilities, transportation, entertainment, and all other regular expenditures. Be thorough and list everything you spend money on.

Tracking Your Expenses

To understand where your money is going, track your expenses for a month. Use a notebook, a budgeting app, or even a simple spreadsheet. This will give you a clear picture of your spending habits.

Categorize Your Spending

Divide your expenses into categories such as housing, food, transportation, and entertainment. This will help you see where most of your money is going.

Income vs. Expenses

Now, compare your monthly income to your expenses. Ideally, you should be earning more than you’re spending. If not, don’t worry; we can work on adjusting your budget.

Identify Areas to Cut Back

Review your expenses and identify areas where you can cut back. Are there any non-essential expenses that can be reduced or eliminated? For example, are there any monthly subscriptions that you are paying but not using?

Prioritize Savings

Make sure that saving money is a non-negotiable part of your budget. Allocate a specific amount toward your savings goal as soon as you receive your income. Treat your savings as an essential expense. Consider setting up an automatic transfer to your savings account on payday.

Stay Flexible

Your budget is a living document, and it’s okay to make adjustments along the way. If you find that your initial budget isn’t working, be open to modifying it to better suit your needs.

3.Building a Strong Savings Mindset

Congratulations on setting up your budget! Now, it’s time to focus on nurturing the right mindset to make your 6-month savings challenge a breeze. Here are some recommendations to help you get in the right mindset.

Visualize Your Goals

Take a moment to visualize what achieving your savings goal will mean for you. Imagine that dream vacation, that new car, or that peace of mind from having an emergency fund. This vision will serve as a powerful motivator.

Create a Vision Board

Consider creating a vision board with images and quotes that represent your financial goals. Place it somewhere visible, like your fridge or your desk, to keep your objectives fresh in your mind.

Set Milestones

Divide your savings goal into smaller milestones. For example: If your goal is to save $5k a month, that may sound like a lot. Instead, you could think in terms of weekly goals, which would be about $192 a week. Celebrate each mini-goal you reach, as this will help maintain your enthusiasm and momentum throughout the challenge.

Stay Accountable

Share your savings goal with a trusted friend or family member who can help keep you accountable. Having someone to share your progress with can be incredibly motivating.

Embrace Setbacks

Understand that challenges and unexpected expenses may arise. Rather than getting discouraged, view setbacks as opportunities to learn and grow. Adapt your budget and keep moving forward.

Positive Self-Talk

Your inner dialogue matters. Replace negative thoughts like “I can’t do this” with positive affirmations such as “I’m making progress” and “I’m in control of my finances.”

4.Tracking Your Progress

You’re well on your way to financial success with your savings challenge, but keeping an eye on your progress is crucial. Tracking your journey will not only keep you motivated but also help you stay on course.

Set Up a Timeline

Create a visual timeline or chart that outlines your 6-month savings challenge. This will give you a clear picture of where you are and where you need to be as you progress.

Checkpoints

Mark key milestones on your timeline, such as the end of each month or specific dates when you plan to hit certain savings targets. Use these checkpoints to assess your progress.

Tracking tools

Explore budgeting apps, spreadsheets or printable templates to help you monitor your spending and savings.

Celebrating Milestones and Achievements

Celebrate your achievements, no matter how small. Did you manage to save more than expected this month? Treat yourself to a small reward. It’s a great way to stay motivated.

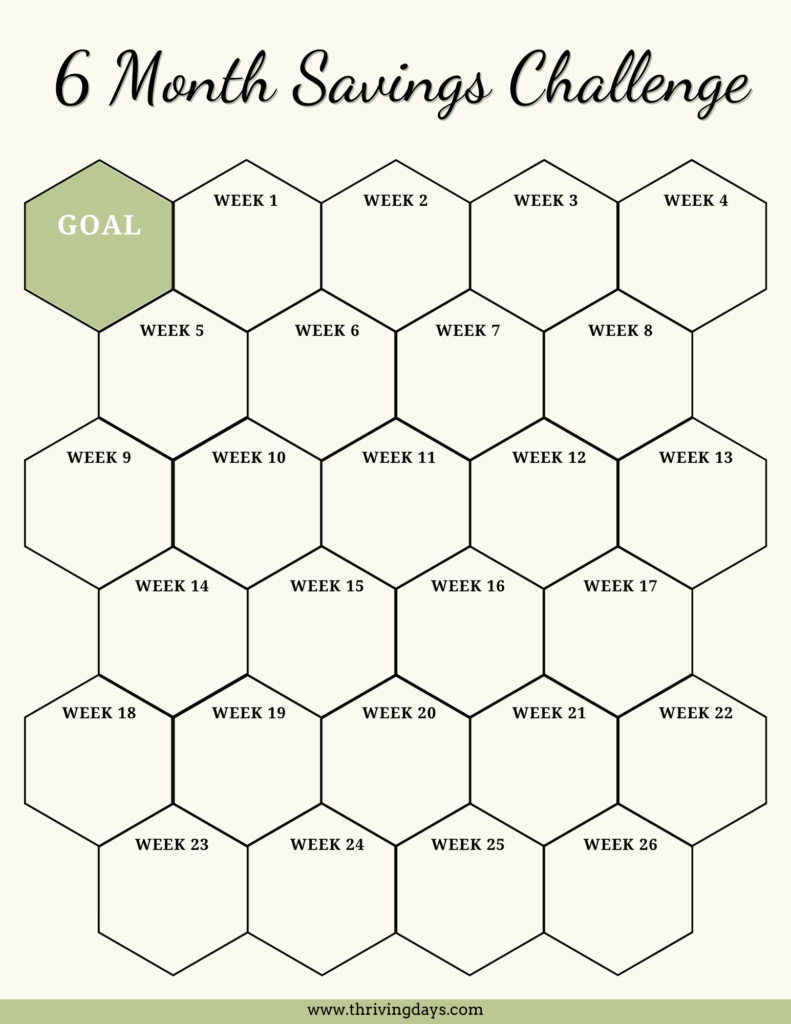

Use these free 6-month savings challenge templates

Here we are sharing 4 different templates that you can use to track your 6-month savings challenge progress.

5. Tips and Strategies for Saving

You’re doing great with your 6-month savings challenge, but a little extra help never hurts! These tips and strategies will supercharge your savings efforts and get you closer to your financial goals.

Automating Your Savings

Set up automatic transfers from your checking account to your savings account on your payday. This way, you won’t even have to think about it; your savings will grow effortlessly.

Side Hustles

Consider taking on a side gig or freelancing opportunities to boost your income. The extra money can go directly into your savings.

Sell Unwanted Items

Declutter your home and make some extra cash by selling items you no longer need. It’s a win-win – a tidier space and a fatter savings account.

Avoiding Impulse Purchases

Before making a non-essential purchase, give yourself a 24-hour cooling-off period. If you still want it after a day, go for it. You’ll be surprised how many impulse buys you avoid.

6. Exploring Savings Options

As you’re rocking your 6-month savings challenge, it’s time to think about where to stash your hard-earned money. Exploring different savings options can help you make your money work for you while keeping it safe and accessible.

Traditional Savings Account

A traditional savings account offers easy accessibility and safety, allowing you to deposit and withdraw funds with ease, backed by government insurance for peace of mind. It’s a low-risk option ideal for emergency savings. However, the downside is its lower interest rates, which means slower growth for your savings, and there’s a risk that the interest earned may not keep pace with inflation, potentially eroding your purchasing power over time.

High-Yield Savings Account

On the other hand, a high-yield savings account provides the benefit of significantly better interest rates, helping your savings grow more rapidly, often with competitive fees and easy online access through digital banks. Yet, some may find it less convenient due to limited physical branch access, and certain high-yield accounts may require higher minimum balances to enjoy the top interest rates. It’s a smart choice for those looking to maximize their savings’ growth potential while maintaining accessibility and lower fees.

Now you are ready to start your 6-month savings challenge. The key is to stay motivated and track your progress. Remember your financial future is brighter than ever, and the path to your goals is well within reach. You’ve got this!