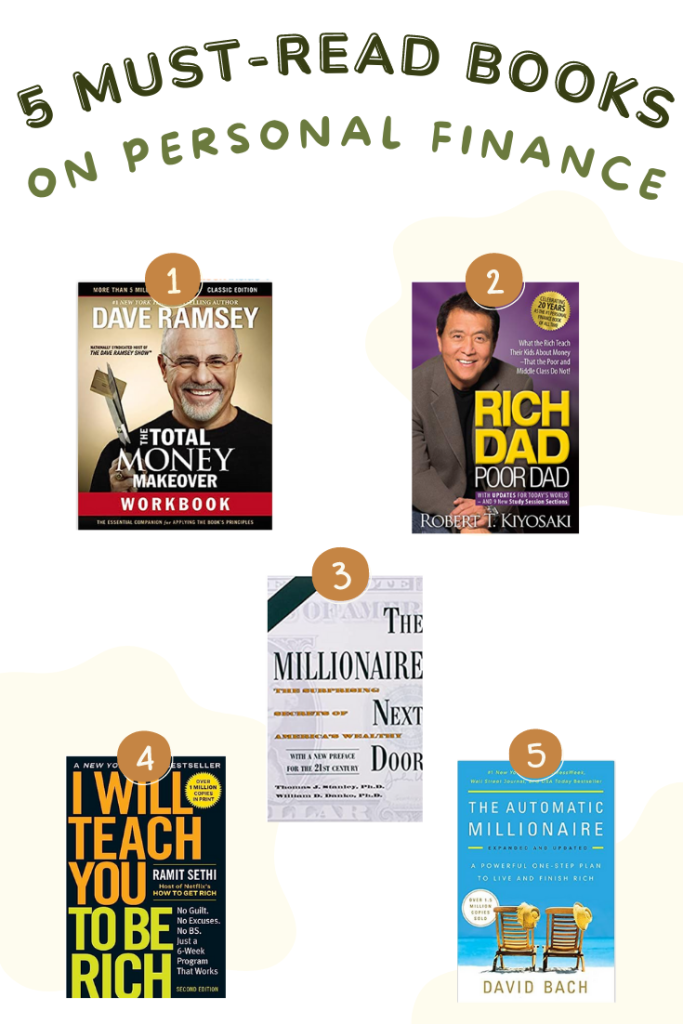

As someone who’s explored the realm of money management and wealth-building, I’m excited to share my insights on five exceptional books that have profoundly impacted my financial journey. Each of these gems offers different lessons and perspectives on personal finances. But if I had to recommend one book, I would choose “I will teach you to be rich” by Ramit Sethi. I know, I hate the title too and I almost did not read it because of that, but it is actually a very beginner friendly and actionable book. Now, let’s dive into my top 5 personal finance book recommendations.

1. “The Total Money Makeover” by Dave Ramsey: Crafting Financial Fitness

Dave Ramsey’s “The Total Money Makeover” is like a financial workout plan for your wallet. The book provides step-by-step guidance on budgeting, debt elimination, emergency funds, and investing. Ramsey’s straightforward approach and the seven “baby steps” to financial freedom are incredibly motivating. This book laid the foundation for my financial transformation, helping me regain control of my money and my life.

Practical Takeaway: Adopt the “debt snowball” method to pay off debts. Start with the smallest debt and work your way up, gaining momentum and psychological wins as you eliminate each one.

2. “Rich Dad Poor Dad” by Robert Kiyosaki: Unleashing the Power of Financial Education

“Rich Dad Poor Dad” by Robert Kiyosaki is a paradigm-shifting journey into financial literacy. Through the contrasting experiences of his “rich dad” and “poor dad,” Kiyosaki challenges conventional beliefs about money and exposes the importance of acquiring assets that generate passive income. Although this book does not offer many actionable tips to implement in your life, it does offer an important perspective in the path to financial independence.

Practical Takeaway: Focus on building assets that produce cash flow, such as real estate investments or dividend-paying stocks, to create streams of passive income.

3. “The Millionaire Next Door” by Thomas J. Stanley and William D. Danko: The Habits of Wealthy Individuals

“The Millionaire Next Door” unveils the hidden truths about the habits and characteristics of self-made millionaires. Stanley and Danko’s research shows that wealth is often built through frugal living, disciplined saving, and strategic investing. This eye-opening book challenged my perceptions of wealth and inspired me to prioritize long-term financial stability over extravagant spending.

Practical Takeaway: Embrace a frugal mindset and prioritize saving and investing consistently. It’s not about flashy spending; it’s about making informed financial decisions.

4. “I Will Teach You To Be Rich” by Ramit Sethi: Smart Money Management for Young Professionals

“I Will Teach You To Be Rich” by Ramit Sethi is a comprehensive guide tailored to young professionals seeking practical financial advice. Sethi covers topics like automating finances, optimizing credit cards, and investing in a relatable and actionable manner. This book equipped me with tools to manage my money effectively and make informed financial decisions. If you are going to read only one book from the list, choose this one. It works almost as a workbook and it can guide you step by step in your journey to transform your personal finances.

Practical Takeaway: Implement the “Six-Week Program” outlined in the book to automate your finances, negotiate bills, and create a solid foundation for long-term wealth.

5. “The Automatic Millionaire” by David Bach: Effortless Wealth-Building Through Automation

David Bach’s “The Automatic Millionaire” introduces the concept of “paying yourself first” and automating savings and investments. The book emphasizes the power of small, consistent contributions over time, leveraging the magic of compound interest. This book taught me the importance of setting up systems that make wealth-building a seamless part of life.

Practical Takeaway: Set up automatic transfers to your savings and investment accounts as soon as you receive your paycheck, ensuring that you consistently save and invest without relying on willpower.

As you embark on your journey toward financial mastery, remember that every step you take counts. These five books, each offering a unique lens on personal finance, have shaped my financial path in remarkable ways. Here’s to mastering your finances, one page at a time!