During the past few years, I have been immersed in the world of personal finances. It was in my late 20s that I realized that despite earning a decent income, I was failing miserably at money management. My bank account was bleeding due to impulsive spending, all the while my student loan debt loomed large. That was when I decided to take control of my financial life.

Having read numerous personal finance books, binge-watched endless YouTube videos by financial gurus, and done my own research, I felt compelled to gather all the pivotal and priceless lessons I’ve gained.

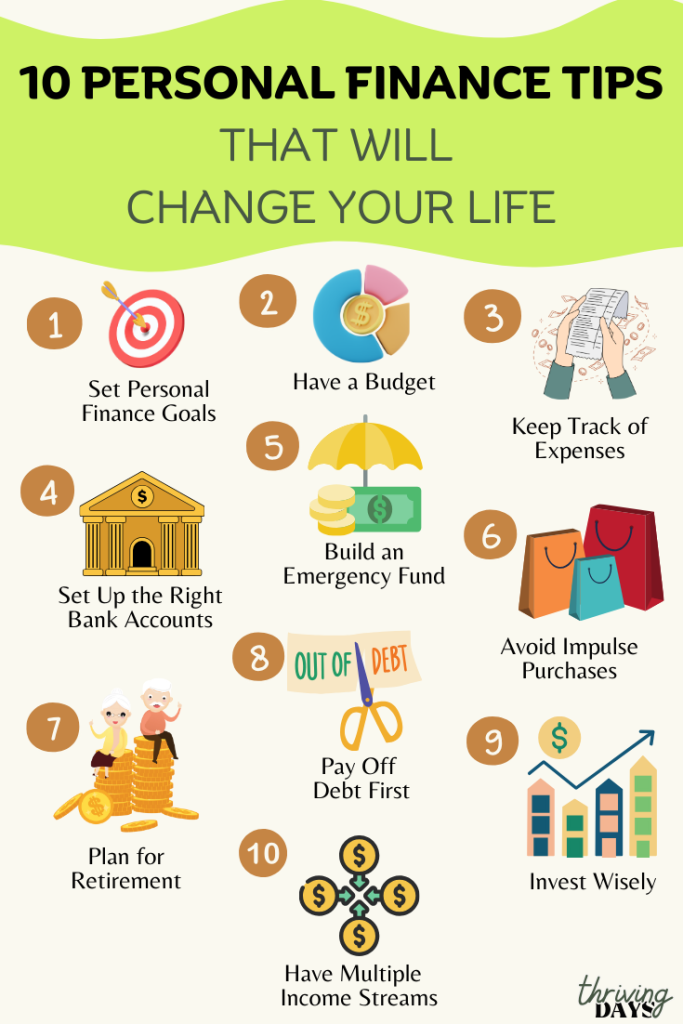

At first glance, it might appear a tad overwhelming, but in reality, most of these steps are surprisingly straightforward to grasp and follow – particularly if you have clear goals. You can embark on this journey by acquainting yourself with these insights and gradually incorporating them, one by one. And you know what? They’re achievable by anyone – no matter your current income or personal circumstances, you can use these tips to build a personal finance plan that works for you.

Disclaimer: While these personal finance tips are based on personal experience and research, it’s important to note that I am not a financial advisor. Every individual’s financial situation is unique, and it’s recommended to consult a qualified professional before making significant financial decisions.

1. Set Personal Finance Goals

Setting clear financial goals is the first step towards financial success. Identify both short-term and long-term objectives, such as paying off debt, saving for a down payment on a house, or building a retirement fund. Well-defined goals provide focus and motivation, making it easier to track your progress.

Try to set SMART goals (Specific, Measurable, Achievable, Relevant, and Time-bound). For example, instead of saying “I want to pay off my student loan”, your goal can be “I will pay off my $30k student loan by December 2024”

2. Have a Budget

Creating and sticking to a budget is crucial for managing your money effectively. Outline your monthly income and categorize your expenses, including necessities like housing, groceries, utilities, and discretionary spending. Also, you want to allocate a portion of your income towards savings and investments.

If this is the first time you are preparing a budget, you can follow these steps to build one:

- Choose a budget tracking tool: You can use a notebook, a budgeting app, a spreadsheet or whatever works best for you. Personally, I created my own budgeting spreadsheet.

- Calculate Your Income: List all sources of income, such as your salary, freelance work, or rental income. Add up these amounts to determine your total monthly income.

- List your fixed expenses: Fixed expenses are payments you have to make most likely every month. Some fixed expenses are rent or mortgage payments, utilities, subscriptions, insurance premiums, and loan payments.

- List your variable expenses: Assign a budget to each expense category. Some categories can be groceries, entertainment, dining out, travel, transportation, and discretionary spending. If you do not know exactly how much you should allocate to each category, start with a guess. As you start tracking your expenses, you will realize how much you actually spend on each category and whether you need to adjust your budget or your spending.

- Allocate some budget to savings and investments: Direct a portion of your income toward savings accounts, investments, and retirement funds. Try to align this with your personal finance goals. For example, if your goal is to build an emergency fund of $12k in the next year, your budget should reflect that by allocating $1k a month to savings.

- Review and Reflect: At the end of each month, review how well you stuck to your budget. Reflect on what worked and what didn’t, and use this information to adjust your budget.

3. Keep Track of Expenses

After you have created a budget, you need to start tracking your expenses to make sure you are sticking to said budget. Tracking your expenses helps you understand where your money is going to identify areas where you can cut back and save more. You will need to use a tool like apps or spreadsheets to record every expense.

4. Set Up the Right Bank Accounts

Choosing the right bank account can save you money in fees and offer better interest rates. You need at least two bank accounts: 1 checking account and 1 savings account. For years, I used to have just a checking account and I made myself believe I was saving money by keeping it in my checking account. Don’t make this same mistake. I always ended up spending that money just because it was easily available and I was also missing out on better interest rates. Ok, so you need two accounts.

Checking account: You want to have a checking account with no fees. Think of your checking account as your email inbox. All your different income sources go into your checking account and from there you send your money to your other accounts or to cover your bills.

Savings account: Research various options, ideally you want to have a high-yield savings account that is FDIC insured. This means that in the unlikely event of bank failure, your money is protected for up to $250k. Personally, I’m using Wealthfront that has an APY of 4.8% (If you are interested in opening an account, you can use this link to get +0.50% on top of the 4.8% APY)

5. Build an Emergency Fund

Life is unpredictable, and having an emergency fund provides a safety net during unexpected financial challenges. Aim to save at least three to six months’ worth of living expenses to cover unforeseen events like medical emergencies or job loss. One of the worst setbacks in your financial journey would be to have to go into debt because you did not have money saved up for an unexpected event.

Do not stress if you currently have $0 dollars allocated to your emergency fund. Start building one today and make it a priority in your budget.

6. Avoid Impulse Purchases

Impulse purchases can quickly derail your financial plans. Before making a non-essential purchase, take some time to evaluate whether it aligns with your goals and if you genuinely need it. I consider myself a recovered shopaholic and these are a few tips to avoid those impulse purchases that have worked for me:

7 days cool-off period: When you want to buy a non-essential item, add it to your wishlist. Come back to check your list 7 days later, do you still want it? If you do, consider buying it. Most of the time, you will find yourself not interested in it anymore.

Can you afford it twice in cash?: When you are considering an expensive purchase, ask yourself if you could afford to buy that item twice and pay cash. If the answer is no, then you cannot really afford it and should not be buying it. Obviously, big purchases such as a car or a house are the exception to this rule.

Save up to treat yourself: Ok, what happens if you cannot afford a designer bag or an expensive watch based on the previous rule? Well, you should save up to buy it. Trust me, you will feel a lot better buying a $3000 designer bag when you saved for 6 months to buy one rather than just swiping your credit card without thinking if you could afford it in the first place.

7. Plan for Retirement

It’s never too early to start planning for retirement. Contribute to retirement accounts like a 401(k) or an IRA to take advantage of compound interest over time. I used to be the kind of person that did not care about retirement in my early 20s because I thought I would just figure something out in the future. Don’t be like old me. The earlier you start, the more time your investments have to grow.

8. Pay Off Debt First

High-interest debt can drain your finances. Prioritize paying off credit card debt and loans with the highest interest rates. Once you’ve cleared these debts, redirect those payments towards savings and investments. If you have to prioritize two things between paying debt, saving for different goals and investment, I would recommend focusing on paying off debt and building an emergency fund.

9. Invest Wisely

Investing can accelerate wealth-building, but it’s essential to educate yourself before diving in. Consider a diversified portfolio that matches your risk tolerance and financial goals. If you’re unsure, consult a financial advisor. An easy way to start is to invest in Index Funds or use a Robo Advisor. I started using Wealthfront as my robo advisor during my first year investing and then moved on to index funds as I learned more and was more comfortable with investing.

10. Have Multiple Streams of Income

Relying solely on one income source can be risky. Explore side gigs, freelance work, or passive income streams like investments or rental properties. Diversifying your income can provide stability and enhance your financial flexibility. According to the IRS, most millionaires have seven income streams. Personally, I have a goal of adding one additional income stream each year.

Implementing these 10 personal finance tips can pave the way for a more secure and fulfilling financial future. Remember that financial success takes time and effort, so be patient with yourself. By setting goals, budgeting wisely, and making informed financial choices, you’ll be well on your way to achieving your dreams.